Mastercard’s 4 New Recurring Payments Rules (and What They Mean for Your Nonprofit)

The financial service provider’s latest mandates aim to minimize payment disputes and chargebacks to organizations and protect supporters from ill subscription billing practices. Mastercard’s regulations will also promote transparent communications regarding membership agreements and scheduled transactions.

For fundraisers and nonprofit organizations, these requirements will solely impact the collection of recurring donations. Although these guidelines went into effect in September for many companies, to allow sufficient time to coordinate and partner with payment service providers, nonprofits will have until March 21, 2023, to roll out enhanced subscription billing to remain compliant with Mastercard’s rules.

At Jackson River, our mission is to ensure fundraisers and nonprofits are well-informed of and in alignment with the latest payment technology regulations. Below is an overview of Mastercard’s new requirements and what they mean for your organization and community.

Rule 1: The terms of a recurring donation must be presented to donors at the time credit card information is collected.

The terms of the subscription must include the following information and electronic communications:

- Amount of recurring gift

- Frequency of donation

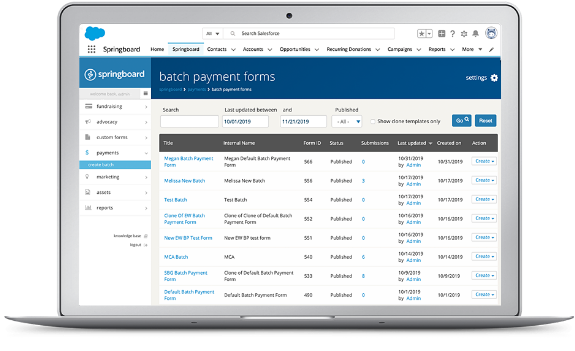

- Payments or Summary page describing the order

- Auto-confirmation email detailing terms and agreement

Additionally, organizations must capture the customer’s acceptance of the terms before the transaction is completed and securely retain a record of the agreement.

Rule 2: An auto-confirmation must be sent upon submission of an initial recurring payment and each gift after that.

The communication should confirm the terms of the recurring donation as well as clearly state cancellation instructions. Correspondence should be distributed via email or another electronic method.

Rule 3: The organization’s recurring donation cancellation instructions must be accessible online.

Donors should be able to easily locate details on how to cancel a recurring donation on your nonprofit’s website. This can include a page or header designated for managing donations, subscriptions, etc.

Rule 4: For recurring transactions with a frequency less than every six (6) months, a reminder must be sent to the donor at least seven (7) days in advance.

Notifications must be sent to donors electronically to the email address on file. Additionally, reminders should be sent no more than 30 days prior to the next billing date. This communication must include: Terms of the recurring donation Cancellation instructions The subject line denoting the correspondence is related to upcoming charges

What these Requirements Mean for Your Organization

With Mastercard’s rules soon going into effect, now is the time to reassess your nonprofit’s current payments system and communications during and post recurring donation sign-up. Organizations should leverage marketing automation tools to create notifications based on sustaining donor workflows. You must work directly with your payments vendor to implement the required changes and remain in compliance with Mastercard’s subscription billing regulations.

Mastercard’s approach to improving the subscription service experience is a win-win for nonprofits and sustaining donors. Embracing these enhancements enables your organization to increase billing transparency, annual revenue, and sustaining donor retention.